Explainer: You could lose your land to government if MPs pass new bill

By Amina Wako |

The Land Amendment Bill No. 2 of 2023 seeks to introduce a new clause that mandates freehold landowners to pay land rent, a move that has sparked widespread scepticism and concern among the public.

The ongoing discourse surrounding the Finance Bill of 2024 has brought to light several contentious issues, including a significant proposed amendment to the Land Act of 2012.

The Land Amendment Bill No. 2 of 2023 seeks to introduce a new clause that mandates freehold landowners to pay land rent, a move that has sparked widespread scepticism and concern among the public.

Keep reading

The proposed levy, criticised by the National Land Commission (NLC) as double taxation, would affect homeowners on ancestral land in urban fringes like Dagoretti in Nairobi and Kiambu towns.

"There should be no levy charged on freehold land apart from rates," NLC chief executive Kabale Tache told MPs in February. "Freehold interests are superior interests and there is no landlord and therefore no rent can be owed."

Although part of the Land Laws (Amendment) (No.2) Bill 2023, the levy has been mistakenly linked to the Finance Bill due to the concurrent anti-tax protests.

The proposed amendment to the Land Act 2012 would introduce a new section 54A, requiring freehold landowners in urban areas to pay an annual levy equivalent to land rent on comparable leasehold land. However, agricultural landowners may be exempt.

SECTION 51 OF THE BILL introduces a new Section 54A to the Land Act, the amendments states that "the owner of any freehold land situate within the boundaries of any urban area or city shall pay an annual land levy, equivalent to land rent charged on comparable leasehold land. pic.twitter.com/c06Gjan70r

— Namati Kenya (@NamatiKenya) June 24, 2024

Mwenda Makathimo, executive director of the Land Development and Governance Institute (LDGI), explains that this essentially means taxing Kenyans for owning land in urban areas.

"This means the government is charging you a tax for owning freehold land which is not government land. That is what this Act will bring. The land you might have inherited from your parents or land that you might have bought is freehold land," he told Citizen TV.

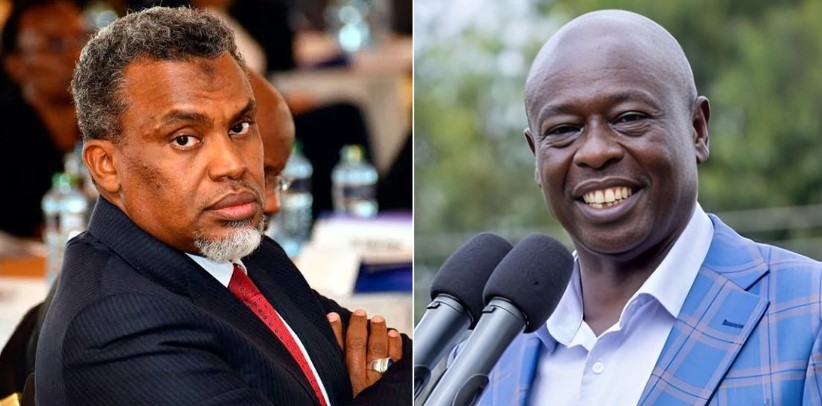

Majority Leader Kimani Ichung'wah has introduced a new bill that includes a provision similar to one he withdrew earlier this year. The previous bill was withdrawn on April 19, as announced by Speaker Moses Wetang'ula.

However, the current bill still contains a controversial levy on freehold land, which has raised concerns among some lawmakers, including members of the committee reviewing the bill. Some MPs who own freehold land are reportedly uneasy about the proposed levy.

Marjorie Kivuva, a partner at Tarra Agility Africa, emphasised the importance of protecting property rights.

"Any amendment should not be contrary to the current title or interest that the person holds. If the Constitution says you have a right to property, that should be protected. If the land law says you have a freehold interest and that interest carries an ultimate or superior title, where you are not paying an annual land rate, that should be considered."

In December, MPs voted to reduce the publication period of the bill from 14 days to one day, expediting its introduction to the House. This decision was made in conjunction with a similar motion to shorten the publication period of the Affordable Housing Bill, another piece of legislation that has garnered significant attention.

Despite claims by the government, through National Assembly Majority Leader Kimani Ichung'wah, that no such bill exists, The Eastleigh Voice has learned it has progressed to the second reading.

A second reading is the stage of the legislative process where a draft of a bill is read a second time. In most Westminster systems, such as Kenya, a vote is taken in the general outlines of the bill before it is sent to the designated committee.

The Land Bill, sponsored by Ichung'wah, was initially scheduled for debate in the National Assembly on June 18. However, its consideration was postponed to prioritise the Finance Bill, which has generated significant public interest and discussion.

The Finance Bill has been the focus of nationwide discussions and demonstrations, primarily due to the introduction of new taxes.