Kenya to use World Bank loan to make $500 million Eurobond payment this month

By Reuters |

Kenya's economy is estimated to have grown 5.8% in the first quarter of this year, after 2023 growth of 5.6%.

Kenya plans to use part of a World Bank budget support loan to make a payment of roughly $500 million on a Eurobond maturing this month, its central bank governor said on Thursday.

The East African country sold a $1.5 billion international bond in February at great cost to fund the buyback of a large portion of the $2 billion bond maturing in June.

Keep reading

Before that, investors had feared Kenya might not be able to repay the bond due to its strained public finances.

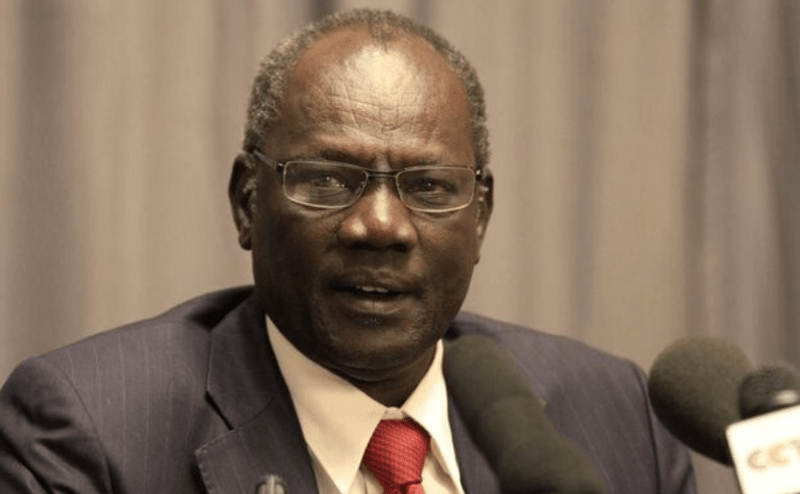

"We do expect some disbursements from the World Bank of about $1.2 billion related to the development policy operations. Part of that ... will be used to settle the $500 million of the remaining Eurobond," Central Bank of Kenya Governor Kamau Thugge told a news conference.

Asked about a World Bank report that said the government was planning another buyback later this year, Thugge said the bank was still in discussions with the Treasury.