Museveni inaugurates Uganda's first-ever licenced Islamic Bank

By Abdirahman Khalif |

President Museveni underscored the transformative potential of Islamic banking in improving Uganda's financial sector while also attracting Muslim investors.

Uganda's financial institutions welcomed a new bank on Wednesday as President Yoweri Museveni officially launched the operations of Uganda's first-ever licenced interest-free commercial Islamic bank.

The inauguration ceremony attended by several top Muslim leaders in Uganda marked the opening of Djibouti-based Salaam Bank.

Keep reading

President Museveni underscored the transformative potential of Islamic banking in improving Uganda's financial sector while also attracting Muslim investors.

He stressed the importance of broad participation in the formal economy for the economic advancement of everyone, including Muslims.

While welcoming Salaam Bank to Uganda, the President recognised Uganda's broad market and reiterated the government's commitment to equality, affirming that all citizens, irrespective of their religious or ethnic background, deserve equal treatment.

"I welcome Salaam Bank to Uganda. This is a big market with a population of 48 million now and in the next 27 years, the population of Uganda will be 106 million. You are going to start right away to serve the people of Uganda," he said.

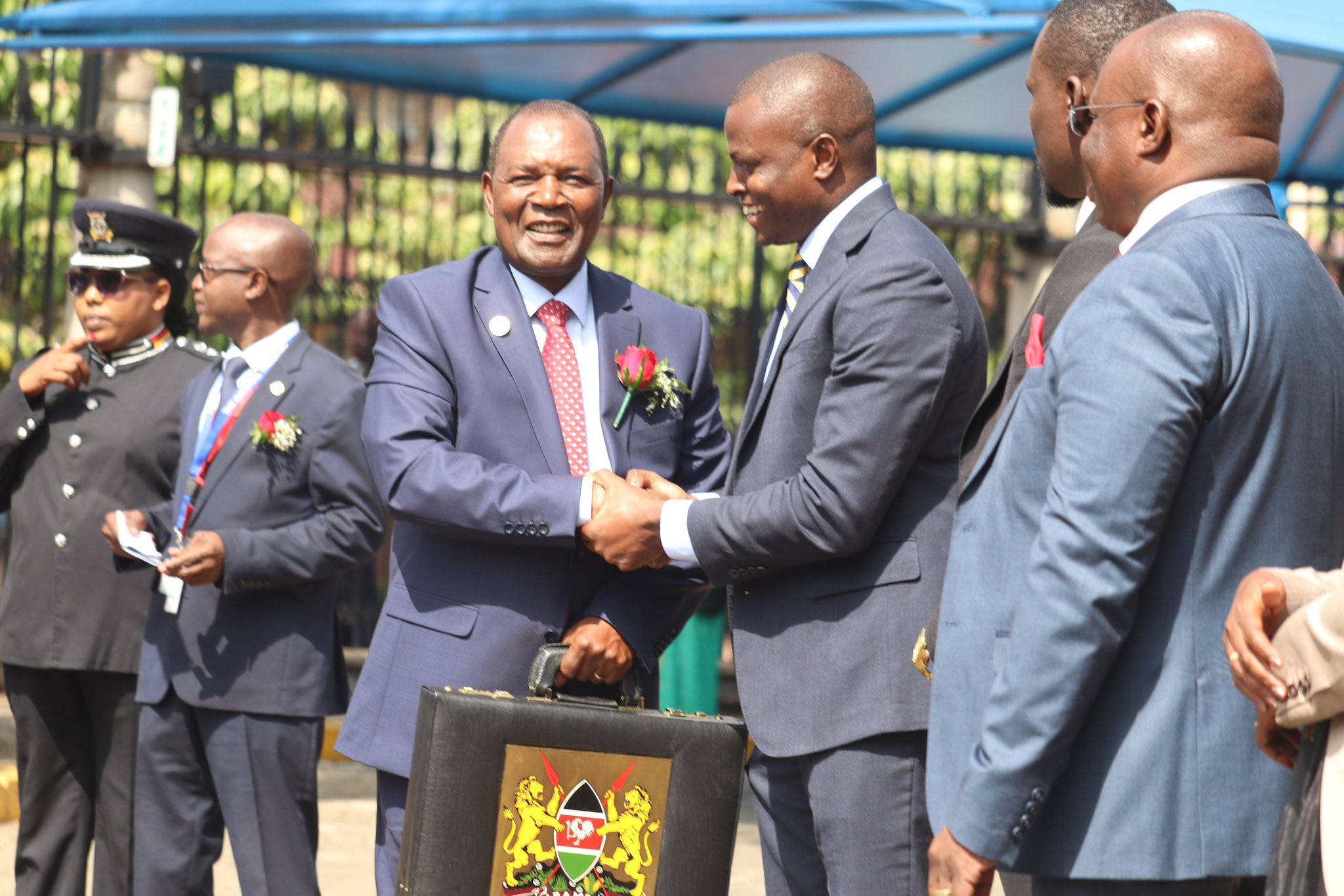

President Yoweri Museveni during the launch of Salaam Bank, Uganda's first-ever licensed Islamic Banking institution on March 27, 2024. (Photo: X/Yoweri Museveni)

President Yoweri Museveni during the launch of Salaam Bank, Uganda's first-ever licensed Islamic Banking institution on March 27, 2024. (Photo: X/Yoweri Museveni)

In September last year, Salaam Bank received its license from the Uganda Central Bank to provide Islamic banking to over six million Muslims in Uganda.

Acknowledging President Museveni's steadfast support for Islamic banking, the chairman of Salaam Bank Uganda Ibrahim M Abdirahman, emphasised its significance in fostering economic empowerment and financial inclusivity across Uganda.

"The establishment of an Islamic Bank marks a significant milestone in Uganda's journey towards economic empowerment and inclusive financial growth," he said.

The establishment of an Islamic bank will provide Sharia-compliant financial products that meet the needs of Uganda's Muslim population, which constitutes about 14 per cent of the total population.

In embracing Islamic banking, Uganda joins a growing number of countries worldwide that have recognised the importance of catering to the diverse financial needs of their citizens.

By offering interest-free banking solutions, Salaam Bank aims to promote financial inclusion and empower individuals and businesses to thrive in an environment that also respects their religious beliefs.